Mortgage rate lock fee calculator

Especially with rates even the most minute change can have a big impact on your estimated mortgage payments. And fixed mortgage rates in the mortgage calculator above.

How To Protect Yourself From Losing A Rate Lock On A Mortgage

ZGMI is a licensed mortgage broker NMLS 1303160.

. This lets you take advantage of lower rates from another lender borrow more money and lock-in a mortgage rate early. By default 30-yr fixed-rate loans are displayed in the table below using a. Using our mortgage rate calculator with PMI taxes and insurance.

30-year fixed mortgages are the most popular mortgage product nowadays and are especially popular among first-time home buyers. Estoppel certificate fee -Total Cash Required -Other Cash Considerations. Its sometimes possible to renew a fixed-rate mortgage early and lock yourself into a new deal with your current mortgage lender without penalty depending on the terms and conditions you.

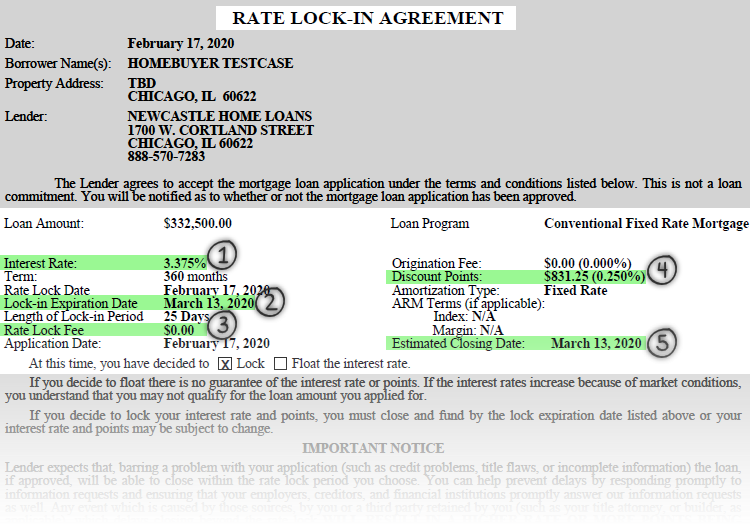

Compare lenders serving Redmond to find the best loan to fit your needs lock in low rates today. Lenders allow you to choose how long you want to lock in 15-day increments. The Wood Group at Fairway Mortgage Rate Lock Guide In this scenario a mortgage borrower would pay 90 per 100000 borrowed for a 30-day rate lock.

The average 30-year fixed mortgage rate rose from around 3 in December 2021 to 581 in June 2022 according to Freddie Mac. A 15-year fixed rate mortgage on the other hand may offer a lower interest rate that wont fluctuate like an ARM loan but requires a higher monthly payment compared to a 30-year fixed. Refinance Today to Lock-in Redmonds Low 30-Year Mortgage Rates Today.

Name of lender or broker contact information. A 30-year fixed mortgage is a mortgage that has a specific fixed rate of interest that does not change for 30 years. Home price Down Payment.

Borrowers usually choose a lock period between 15 and 90 days although with some lenders you can lock your rate for a longer period of time like for new constructions. Fixed-rate mortgage interest rate and annual. Leaving a Fixed Rate Mortgage Early is possible but you may face an early exit mortgage fee.

Keep in mind that longer rate lock periods may come with a fee. Central Daylight Time and assume borrower has excellent credit including a credit score of 740 or higher. Here are the average annual percentage rates today on 30-year 15-year and 51 ARM mortgages.

The average fixed-rate mortgage was priced at 191. Please call us on 1300 889 743 or complete our free assessment form to talk to one of our mortgage brokers who can offer you practical advice. Is there a 90-day mortgage rate lock.

Name of lender or broker contact information. Loan term eg 15 years 30 years Loan description eg fixed rate 31 ARM payment-option ARM interest-only ARM Basic Figures for Comparison. Since the base rate began rising in December 2021 the two-year rate has increased by 091 per cent and the five-year rate by 073 per cent.

This payment amount only includes principal and interest based on a fixed-rate mortgage. Mortgage interest rates have been volatile throughout the summer and. These forecasts are intended to help you with new mortgages refinancing and mortgage renewal decisions.

Then select an amortization period and mortgage rate. Our mortgage refinance calculator can help borrowers estimate their new monthly mortgage payments the total costs of refinancing and how long it will take to recoup those costs. If you choose a 30-year fixed mortgage your monthly payment will be the same every month for 30.

Use the Early Mortgage Payoff Calculator to Determine the Actual Savings. Two-year forecast of the interest rates that will be charged on Canadian 5-year fixed-rate and variable mortgages extrapolated from predictions for the Bank of Canada Target Rate and the yield on 5-year Canadian government bonds. The rate lock fee may be a flat fee a percentage of the total mortgage amount or added into the interest rate you lock in.

Step 34 Run the numbers. According to the Bank of England since 2016 fixed-rate options are more preferred by borrowers especially first-time homebuyers. Refinancing has more variables.

This calculator will illustrate the potential savings. Todays Mortgage Rates Today the average APR for the benchmark 30-year fixed mortgage remained at 3. This is called a rate lock period.

If youll be using an adjustable-rate mortgage this amount only applies to the fixed period. View all mortgage calculators. Changing your mortgage rate type will change the mortgage terms available to you.

As long as you dont close your loan you can use a flexible fixed rate to enjoy the extra repayments of a variable interest rate without the uncertainty of interest rate fluctuations. Most lenders will lock a rate for 30 days with no fee. You input your original mortgage amount and can quickly see what paying extra will do in terms of both interest savings and shaving years off your mortgage.

As long as your mortgage payment hasn. What happens if my mortgage rate lock expires before closing. How much money could you save.

Loan term eg 15 years 30 years Loan description eg fixed rate 31 ARM payment-option ARM interest-only ARM Basic Figures for Comparison. Fixed-rate mortgage interest rate and annual. Refinance rates valid as of 31 Aug 2022 0919 am.

In the third quarter of 2020 912 of all mortgages used fixed-rate loans. The fees may be refundable or non-refundable. Home inspection fees 300 - 500.

Some mortgage lenders offer long-term mortgage rate locks including 90-day lock periods. Secure a great mortgage rate and lock in your monthly mortgage payment now. Read our Guide to find out how a specialist broker can help.

Rate lock agreements are typically no shorter than 15 days and no longer than 60 days. Apply to refinance as soon as youre ready and lock your new mortgage rate. The calculator shows the best rates available in your province but you can also add a different.

Of paying off your home loan ahead of schedule. Because of this many consumers find fixed-rate mortgage options more attractive. Apply to refinance.

But rates change daily. Fixed-Rate Mortgage ARM 1 ARM 2 ARM 3. Five-year fixed rates are by far the most popular.

Get a sense of the costs of buying a home with our monthly mortgage calculator. Fixed-Rate Mortgage ARM 1 ARM 2 ARM 3. Note 3 VA loans require an upfront one-time payment called a VA funding fee collected at closing.

Fee or a non-sufficient funds NSF fee. ARM interest rates and payments are subject to increase after the initial fixed-rate period 5 years. Estimated monthly payments shown include principal interest and if applicable any required mortgage insurance.

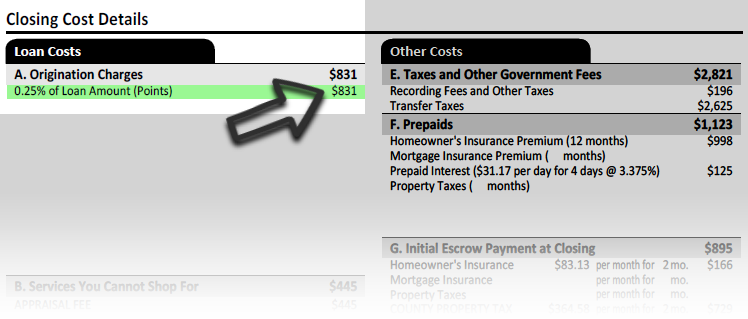

Typically short-term rate locks those less than 60 days are free or cost roughly up to about 025 050 percent of the total loan or a few hundred dollars. A good monthly home mortgage calculator tells individuals not only if they can afford a selected home but what kind of factors might influence future payments. Estimate my monthly mortgage payment.

Given that ARM loans are variable the interest rate could end up being higher than with a 30-year fixed rate mortgage that has a locked-in mortgage rate.

Should You Pay To Extend A Mortgage Rate Lock Mybanktracker

Mortgage Rate Lock How And When To Lock In Your Mortgage Rate

Should I Lock My Mortgage Rate Today And How To Do It Sofi

How To Lock In A Low Mortgage Rate

Why It S Super Important To Lock Your Mortgage Rate

How To Lock In A Low Mortgage Rate

How To Lock In A Low Mortgage Rate

How To Lock In A Low Mortgage Rate

When To Lock In A Mortgage Rate Zillow

Mortgage Pricing Adjustments How To Read A Mortgage Rate Sheet

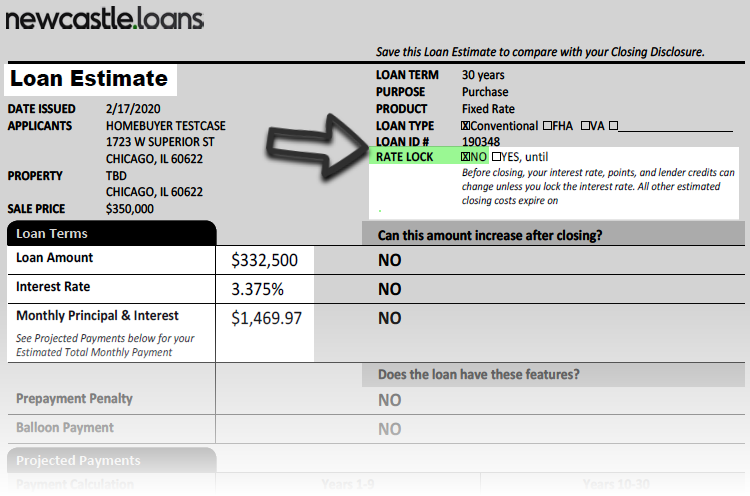

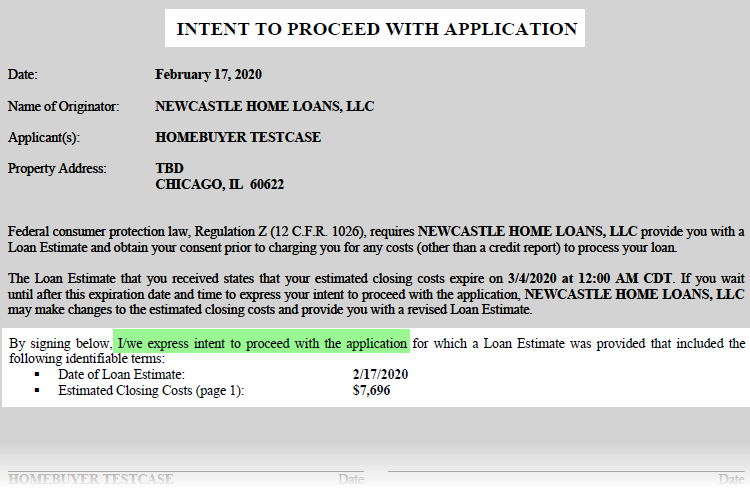

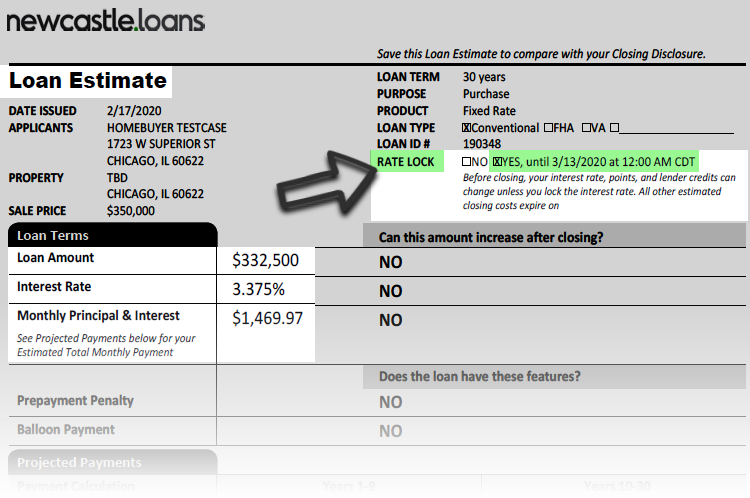

What Is A Loan Estimate How To Read And What To Look For

How To Read A Mortgage Loan Estimate Nextadvisor With Time

Why It S Super Important To Lock Your Mortgage Rate

Buyers Here S How To Decide Whether You Want A Mortgage Rate Lock

How To Lock In A Low Mortgage Rate

When Should You Lock Your Mortgage Rate Money

How To Lock In A Low Mortgage Rate